Digital Banking Identity Verification

Security and protection are vital features when it comes to banking. We've integrated stronger cybersecurity protections to detect fraud, while ensuring you have a positive digital banking experience.

Every time you login to digital banking, our identity verification process will not only confirm your credentials but also the device you are using. If the system detects a new device or suspicious activity, you may be asked to further verify your identity via a one-time, six digit passcode sent to your phone.

Simple set up:

For future identity verifications, all we need is a phone number. When you log in through the browser or our mobile app, you will be asked to set up your verification phone number. Verify your home, work, and mobile numbers are accurate when following the on-screen prompts and edit if needed before continuing to the next step.

How it works:

This authentication process replaces security challenge questions and will only be activated if it detects a login attempt that falls outside of how you typically login.

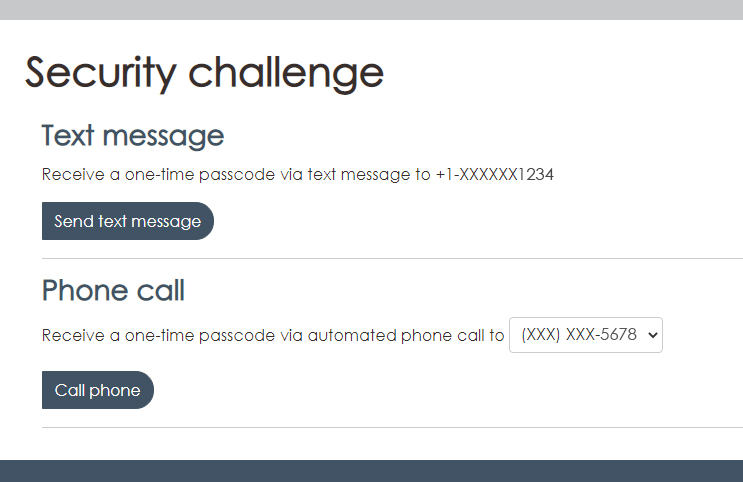

When this happens, you will be prompted to enter a passcode when logging in. The six digit passcode will be sent to the phone number you set up previously using your preferred delivery method (text message or phone call). Simply enter the passcode to complete your log in.

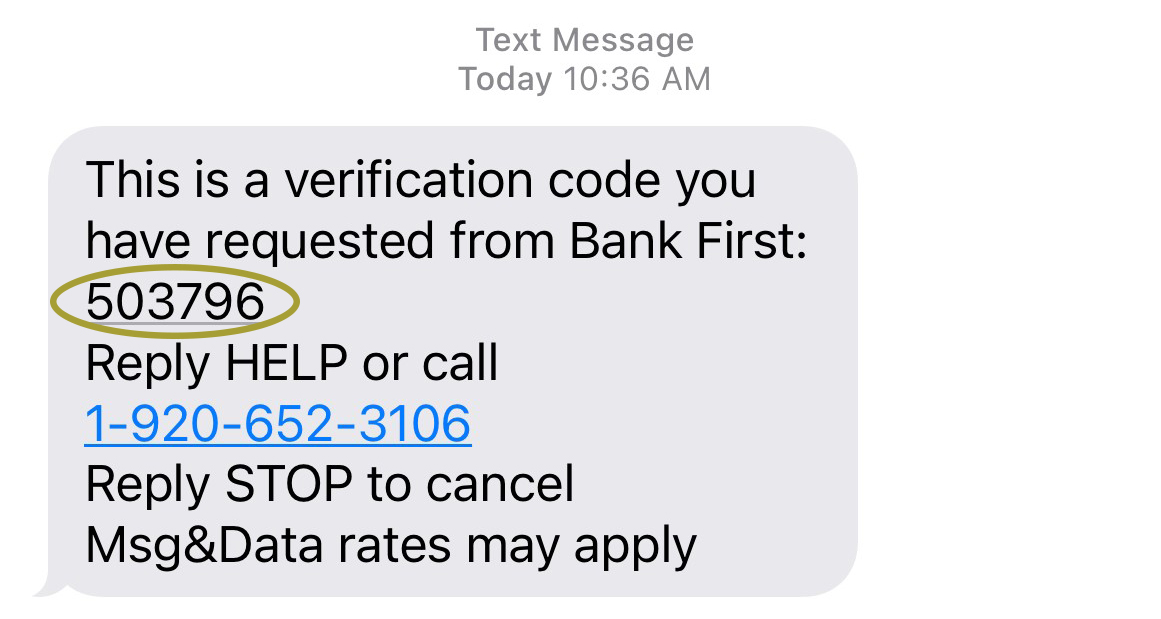

Here is an example of the six digit passcode you will receive via text message:

We continue to look for ways to improve the security of our digital services. If you have any questions, please contact your local office or visit any of our convenient locations.

Frequently Asked Questions:

How does this security feature work?

This additional layer of protection confirms not only your credentials, but also the device you are using during login. If the system detects a new device or suspicious activity, you may be asked to verify your identity with a one-time, six digit passcode sent to your phone.

How do I set this up?

The first time you log into your digital banking account through our website or mobile banking app, you will be asked to set up your verification phone number in order to choose your preferred delivery method – text message or phone call. Verification passcodes can only be sent via text message if a mobile phone number is included. **Digital banking users joining Bank First through a merger may be asked to establish security challenge questions as well as phone verification numbers.**

You will then receive a text message or phone call containing a six digit passcode. Enter this passcode during login to complete your phone number verification. Once entered, you will be logged into online banking.

Am I required to set this up?

Yes, your enrollment in this new security process is required.

How will this feature work in the future?

Once set up, authentication will only be activated if it detects a login attempt that fails outside of how you typically login. When this happens, you will be prompted to enter a passcode during login. The passcode will be sent to the phone number you set up previously using your preferred delivery method. Simply enter the passcode to complete your login.

What if enter the incorrect passcode too many times and get locked out?

If you are locked out or receive any other alerts when you attempt to login, please contact your local Bank First office for assistance.

What if I access my account with more than one phone?

If you are sharing online login credentials with another signer on your account, the best solution would be to have them enroll in digital banking to receive their own username and password. This can be done through our website by choosing “New User” under Account Access or by contacting your local Bank First office. This will ensure all users can verify access with their own phone number(s) with the new security enhancement.

If you personally utilize multiple phones to access digital banking, we recommend adding the phone numbers you use the most to the new verification process.

Will this affect the mobile app?

Yes, the same new security set up and process will apply to logging in via our mobile banking app.

Can I register or change my verification phone number from the mobile app?

No. You must log into digital banking via our website to update your verification phone number. Or call your local Bank First office and our team will be happy to assist you.

Is there a cost?

There is no cost to you for this additional protection. It is part of our ongoing commitment to keeping our account holders and their accounts safe and secure.