Posted in Security

Do NOT share your digital banking credentials, debit/credit card information, or security codes with ANYONE - under ANY circumstances.

We’ve received reports of scammers posing as Bank First in phone calls. These fraudsters may even fake caller ID so it looks like Bank First is calling. They often claim there’s an urgent problem with your account and ask you to “verify” your login or provide a security code sent to your phone.

Do not share this information - these calls are scams.

Please note that there has not been a data or security breach at Bank First, and your information has not been compromised through our systems. Scammers can and do gather publicly available information or use social engineering tactics to make their calls sound convincing. We urge you to be vigilant and cautious at all times.

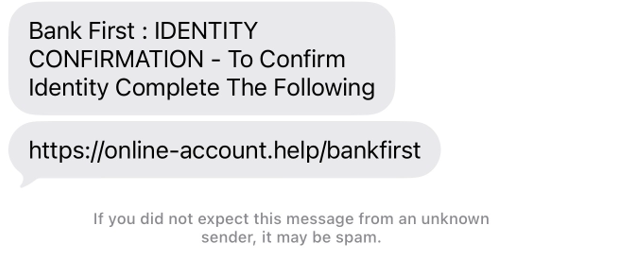

The example below shows a scam text. It may look convincing, but it did not come from Bank First.

Bank First will NEVER:

- Call you to ask for your digital banking username or password

- Unexpectedly request your one-time passcode for an action that you have not initiated

- Send you a link to verify your identity

- Ask for your debit card PIN or full card number over the phone

If you share this information, even if you believe the caller is helping, you give scammers full access to your account. This can lead to major financial losses that may not be recoverable.

If You Receive a Call Like This:

• Do NOT provide any information

• Hang up immediately

• Call us back using the number on your statement or on our website

Our employees will never mind if you hang up and call back - scammers will.

Your vigilance is the best defense against fraud. Thank you for helping us protect your identity, your accounts, and your financial security.

PROTECT YOUR BUSINESS ACCOUNTS

Fraud and scams continue to evolve - and businesses are a frequent target. At Bank First, we offer enhanced security tools to help safeguard your business checking and electronic transactions. While we maintain industry-standard fraud prevention practices, no system is entirely immune. That’s why we strongly recommend adding extra layers of protection, such as Positive Pay, to detect suspicious activity and reduce your liability risk.

To learn more about fraud prevention tools available for your business, contact our Treasury Management team at (920) 652-3515 or treasurymanagement@bankfirst.com.